Introduction

At Mulvihill Capital Management, we employ an option strategy that is designed to enhance yield, while simultaneously reducing the risk profile of your underlying portfolio. Covered call writing involves selling call options on a security that is held long in a portfolio. This strategy is generally viewed as a conservative investment strategy compared to a long only portfolio. In addition to any dividends earned on the underlying security, a call writing strategy will generate cash flow from call option premiums; this is known as Yield Enhancement.

Benefits of covered call writing include:

- Lower volatility

- Enhanced yield/cash flow

- Improved returns in volatile markets

- Favourable tact treatment of option premiums received

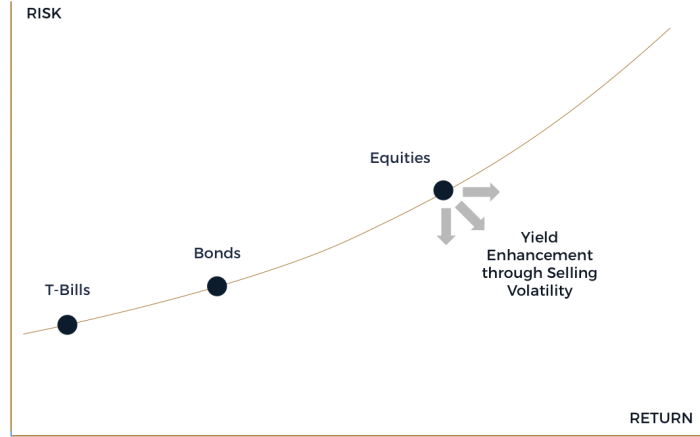

There is generally a trade-off between risk and return. When an investor takes on a greater risk, and therefore, the return should be greater to compensate. A greater risk also implies higher volatility in the price movements of the security. A covered call strategy allows the portfolio to benefit from volatility by writing options (selling volatility); this generates cash flow. This cash flow mitigates the risk of a market price decline by the amount of the option premium received, which has the effect of lowering the portfolio volatility, while increasing the risk adjusted return.

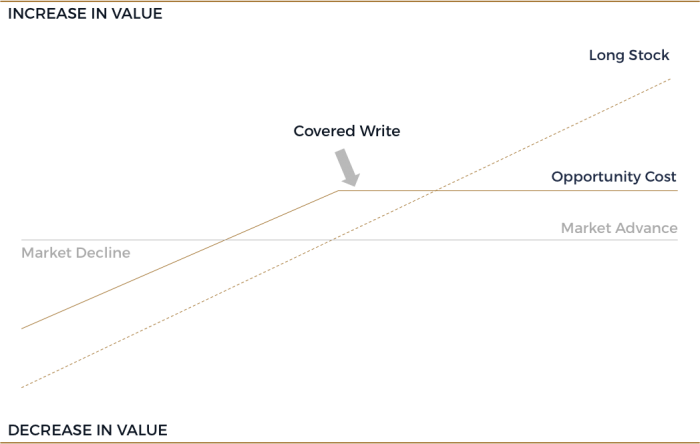

Enhanced yield, combined with reduced risk as a result of the option premiums received may increase the risk adjusted return compared to a long only portfolio. Notwithstanding the option premium received, a covered call strategy may limit upside potential as the security may be called away at a price below the current market price. Assessing this opportunity cost is critical in determining the success of any covered call strategy. As long as the option premium adequately compensates the portfolio for the potential foregone upside, covered call writing is an attractive risk reduction strategy.

To learn more about our strategies for enhancing yield while reducing risk, contact us today.